There’s no doubt that self-made millionaires know a thing or two when it comes to money. Everything from building wealth, to being an A-grade penny-pincher, these 5 millionaires have a piece of advice or two when it comes to you and your money. Agree with their advice? Keep reading to find out!

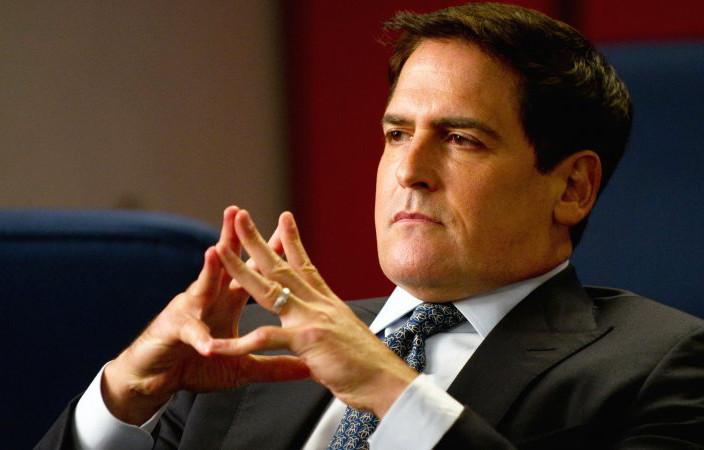

Live cheaply so you can use the extra money towards other opportunities – Mark Cuban

Mark Cuban, aka the shark tank billionaire, prides himself on the fact that before his wealthy days, he was living frugally. And we’re talking real frugal, as in: living with 5 roommates and dining on mac and cheese. Cuban advises to ditch the fancy cars, the luxurious vacations, and the designer clothing. Instead, he recommends putting that money towards other opportunities. “The more you stress about your bills, the more difficult it is to focus on your goals. The cheaper you can live, the greater your options.” In other words, be as poor as you possibly can be, first.

Source: Business Insider

Start investing as soon as possible – Tony Robbins

Now, we’re also HUGE believers of this one. Start investing as soon as possible (aka you should have started yesterday). You need to give yourself time to learn and understand the basics of investing, but start now! Investing at a young age is so important because of compound interest. Compound interest is your BFF, and the sooner your start investing, the sooner that cash money can grow. Robbins advises to diversify your investment portfolio and avoid putting all your eggs in one basket. Roger that, Tony!

Source: Blinkist

Hustle and don’t splurge – Gary Vee

If you’ve followed anything on Gary Vee, you know he’s always talking about the importance of starting, even if you’re starting small. Sell, sell, sell, is how it goes. Whether you’re selling your old stuff or baseball cards (like Gary Vee used to do so himself), find a way to hustle and make that extra cash. The key is though, not splurging on that fancy watch after you get that money. Similar to Mark Cuban’s advice, Gary Vee is all about reinvesting that cash into your business. Focus on the long-term instead of material short-term items.

Source: Gary Vaynerchuk

Avoid using money that you don’t have, in other words: credit – Barbara Corcoran

It’s easy to swipe that credit card to get all the things you’ve ever wanted, but reality is, unless you have more cash than that in the bank, that money isn’t yours. Corcoran advises to try spending one week not using credit, and only purchasing items with cash. Not only will this help you keep your spending to a minimum due to limited cash, but you’ll start to see exactly how much money you’re wasting. Experimenting by using cash instead of credit can no doubt make your budget come to life. You become so much more aware of each and every transaction and exactly how much you’re spending. This will help avoid creating a habit where you spend money before you get it.

Source: Business Insider

Don’t buy a home until you have kids – Kevin O’Leary

According to Kevin O’Leary, aka Mr. Wonderful, there isn’t a need to buy a home until you have kids. His reason why: homes may not be gaining as much value as quickly as we hope they do. With changing interest rates, O’Leary advises that you take a close look at your mortgage rates and interest rates before you take on the massive commitment of housing debt (aka your mortgage). In other words, in his opinion, a home isn’t as safe of an investment as it may seem. Rather than taking on the risk at a younger age where there’s more instability in your career and life, he suggests postponing the purchase of a home until you’re more settled in.

Source: CNBC